Payroll Services in Japan - Outsourcing by HTM

Payroll Services

Our Payroll Services, outsourced from Tokyo and covering all Japan, include maintenance of payroll allowances, deductions, and personal data required for producing all the Japanese social insurance and payroll tax requirements. HTM Payroll Services include:

Payroll System

Our Payroll System (Web-based) handles:- Company, employee, and payroll data management

- Processing of the whole payroll cycle, including monthly payroll, social insurance, and tax

- Payroll payment and reporting

Payroll Reporting

Payroll Reporting by the Payroll System includes comprehensive reports, detailing all elements of employee compensation. These are prepared in advance of the payroll date for approval by your management personnel.Payments to Employees

Payments to Employees are transferred directly to your employees' bank accounts. If desired, employees may predetermine percentage splits for deposit into multiple accounts. Pay slips are sent directly to the employees by HTM. These can be in Japanese or English, depending on individual preference.Year-end Tax Adjustments (YETA)

Year-end Tax Adjustments (YETA) can be managed by HTM. The YETA is a means by which Japanese companies do the personal tax return filing of employees--with some exceptions, such as high-income earners.Statutory Reporting and Payments

Social Insurance & Tax Office Reporting and Payments can be managed by HTM.

Time Reporting System

Time Reporting System (Web-based) allows employees to enter their work time on a daily basis from an internet connection anywhere in the world. Because the time is maintained in HTM's database, it is easy for management personnel to view any individual's time, as well as extract reports for group analysis. Because the data is real time, managers may examine overtime status at any time during the month. This data is required for payroll calculations.Employee Expense Reporting System

Employee Expense Reporting System(Web-based) can allocate expenses to specific projects and specific locations, and where appropriate, can be exported for use on customer invoices. All employee expense activity is stored in an SQL database, which allows management to analyze data quickly and make business decisions in a timely manner. Expenses are reimbursed to employees together with payroll compensation.Employee Housing System

Employee Housing System tracks employee apartment leases held by the company, including fees, deposits, monthly rent payments, and payments required by the employee.Payroll Reporting

The Business Information Portal (BIP) provides online standard payroll reports as well as an interactive graphical view of compensation as well as a payroll calendar for reference.

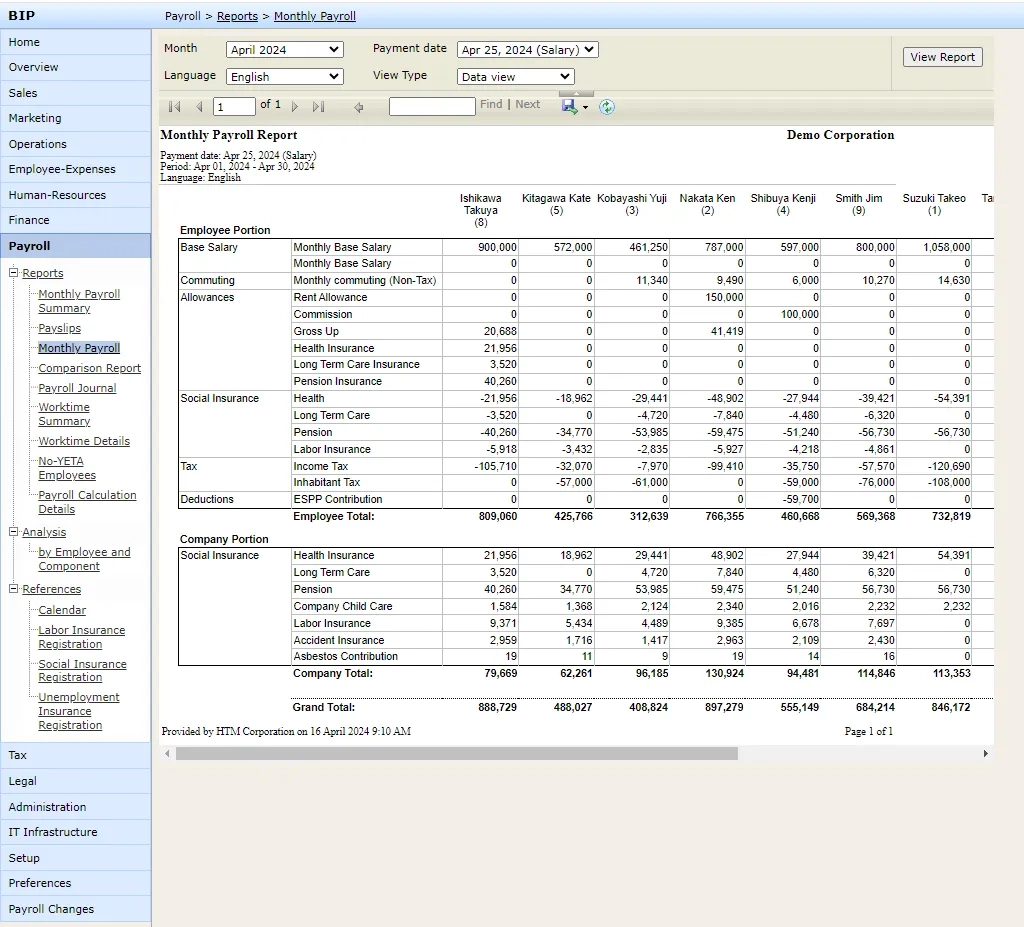

Monthly Payroll Report

Each month the payroll report can be viewed directly online from the Business Information Portal. The payroll report is broken down by component and also displays the company contribution to social insurance.

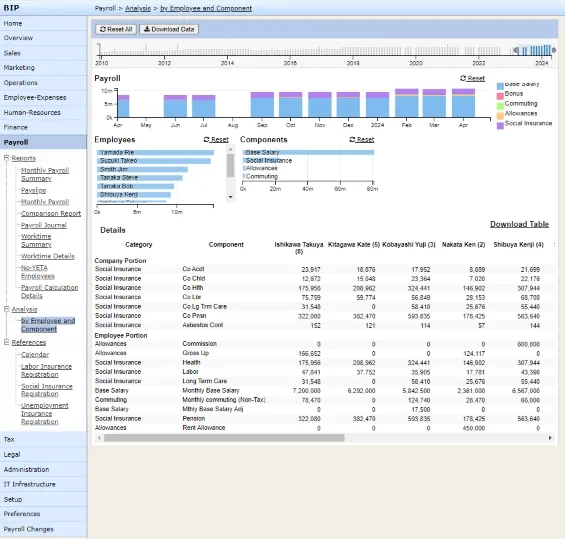

Payroll Analysis

The Business Information Portal also offers this interactive view of the payroll broken down by month, employee and component. The default view displays the previous 12 months but can be set to any time frame.

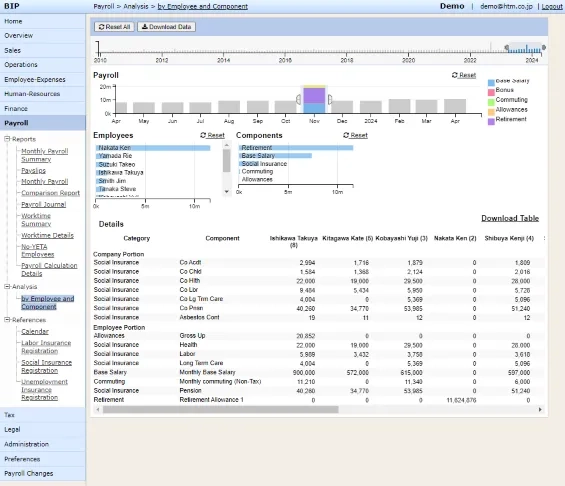

Drill Down

In this example here, November of 2023 was higher than usual. Clicking on the bar will then filter the entire view to just November 2023.

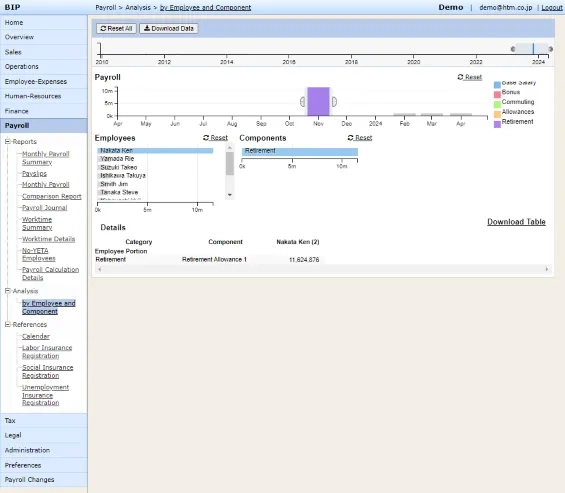

Details on Demand

Click on any component or employee and the details will filter to your selection. Here the view is filtered to show the retirement amount paid to an employee for November 2023.

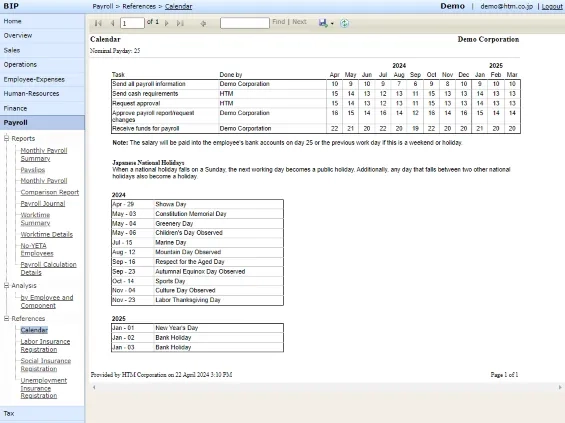

Payroll Calendar

A Payroll Calendar is also provided for reference. The Payroll Calendar outlines the tasks and due dates that are required each month by both HTM and the client. Upcoming Japanese National Holidays are listed for further reference.

Email us

Email us